Most people know how to buy Bitcoin. But in 2025, with over $2.5 billion already stolen in crypto hacks this year alone, almost none know how to store it safely.

Let’s get real—buying Bitcoin is the easy part.

The real challenge? Keeping it secure from phishing, malware, and breaches like the $1.46 billion Bybit hack in February.

Every month, headlines scream: another user hacked, another wallet drained, another scam siphoning millions. What ties them all together? Poor storage choices.

If you’re serious about Bitcoin, whether you’ve dipped in with $100 or you’re stacking for the long haul, mastering hot wallets vs. cold storage could be your smartest move yet.

Because Bitcoin has no “forgot password” reset. Protect your keys, or lose it all.

Let’s break down the two wallet types and guide you to the best fit for your lifestyle, risk level, and Canadian Bitcoin goals.

Hot Wallets vs. Cold Storage—What You Need to Know

🔥 What Is a Hot Wallet?

Hot wallets stay online for quick, seamless use perfect for daily transactions. Picture it as your everyday digital pocket: fast and handy.

You might already use one if you:

- Rely on mobile apps like Trust Wallet, Exodus, BlueWallet, or Zengo (a top 2025 pick for beginners).

- Keep crypto on exchanges like Binance or Coinbase.

- Opt for web-linked desktop wallets.

Why choose hot wallets?

- Instant send/receive for Bitcoin.

- Ideal for frequent trades or payments.

- Simple setup with intuitive apps.

The catch? Internet exposure invites risks like malware, phishing, or exchange exploits—especially with AI-powered attacks surging in 2025. For Canadians, ensure your hot wallet complies with FINTRAC regulations to avoid legal snags.

🧊 What Is Cold Storage?

Cold storage keeps everything offline—your private keys never hit the web, locking out hackers. This is your impenetrable crypto vault.

Common options include:

- Hardware devices like Ledger Nano X, Trezor Safe 5, Coldcard Q, or Tangem (simplicity standout for 2025).

- Air-gapped computers or USBs.

- Paper wallets (QR codes printed out).

Why go cold?

- Perfect for long-term holders skipping daily access.

- Supreme security for big holdings against online threats.

- Total peace knowing hackers can’t touch it remotely.

Downsides? Slower fund access, and you must safeguard the device or seed phrase—no losing it!

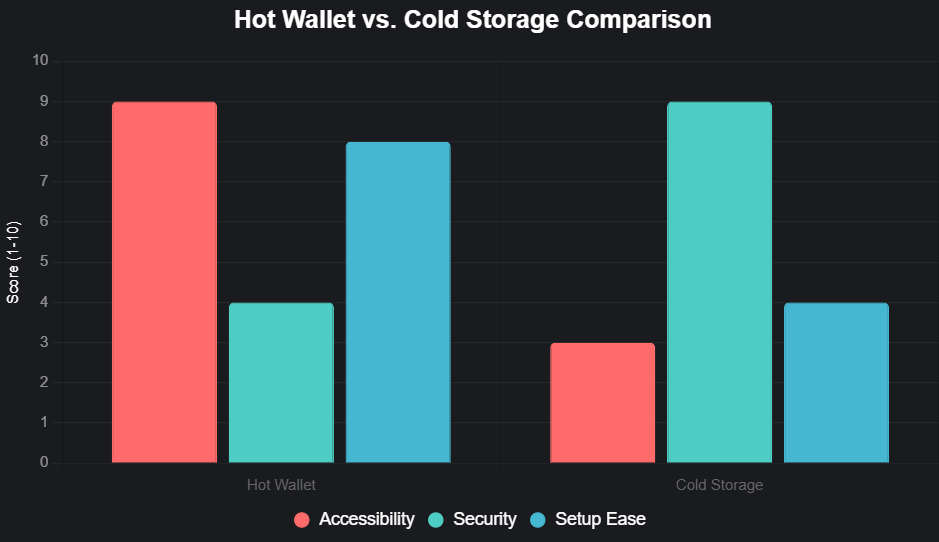

Wallet Comparison at a Glance

Accessibility: Hot wallets score high (≈9/10) because they’re always connected to the internet, making transactions quick and convenient. Cold storage is slower to access (≈3/10) because it requires physically connecting or accessing the device.

Security: Cold storage leads (≈9/10) since it’s offline and immune to most online hacks. Hot wallets are more vulnerable (≈4/10) due to constant online exposure.

Setup Ease: Hot wallets are quick to set up (≈8/10) with minimal steps. Cold storage setup is more involved (≈4/10), requiring hardware initialization, secure backups, and additional safety checks.

Sources: Investopedia, Ledger Academy, CoinWeb

Picking the Perfect Wallet for Your Bitcoin Journey

No universal winner. The right choice hinges on your Canadian habits:

👉 Just Starting Out? Dive in with a hot wallet for hands-on learning. Limit it to small sums you can risk like pocket change, not your savings.

👉 Holding Long-Term? Shift most to cold storage. The setup pays off, especially if you see Bitcoin as a 5-10 year bet against inflation.

👉 Active Trader? Hybrid it: Hot wallet for quick moves, cold for core savings, mirroring checking and savings accounts.

Pro Tip: Enable multi-signature or biometric auth, and back up seeds offline. With wallet hacks up 15% in 2025, these are musts. For e-Transfers, note Canadian business hours (6 PM EST)—funds process same business day if sent before cutoff. Check with your bank for exact times.

Level Up Your Bitcoin Security Like a Pro

We’ve guided dozens of Canadians through wallet setups from seed phrase best practices to picking durable hardware.

Need hands-on help? Grab our free Bitcoin Starter Guide for easy, step-by-step instructions tailored for Canada.

📩 DM us “WALLET” on Instagram, or click here to get it tonight. Start securing your Bitcoin before the clock hits midnight!

Because buying Bitcoin is step one.

Securing it? That’s what makes you a true Canadian Bitcoiner.

Own your future with Bitcoin! We make it simple, secure, and Canada-focused at 1Bitcoin.ca.

Disclaimer: Crypto involves risks; always research. Past security isn’t a future guarantee.