What Was Money Before Dollars and Apps?

Imagine trading chickens for shoes or shells for bread. No wallets, no apps just bartering goods to get what you need. Money as we know it is a recent invention, evolving over centuries to meet society’s needs. From livestock to gold coins to Bitcoin’s digital revolution, the story of money is one of innovation and trust. How did we get from bartering to Bitcoin, and what’s next? Let’s dive in.

Money’s Evolution in Five Stages

1. Barter: Trading Without Cash

Before money, people bartered swapping goods or services directly. A farmer might trade wheat for a shoemaker’s boots, but only if the shoemaker wanted wheat. This double coincidence of wants—where both parties need each other’s goods—made trade clunky and inefficient.

2. Commodities: The First Step Toward Money

To simplify trade, societies used valuable items like salt, cattle, or shells as early money. These commodity currencies were widely accepted but had flaws: salt could dissolve, cattle needed feeding, and shells varied in value. Still, they made trade easier than bartering.

3. Gold and Silver: The Rise of Coins

Around 600 BC, civilizations like the Lydians minted gold and silver coins. Durable, divisible, and universally valued, these metals became the first true money. Governments standardized coins, boosting trade and trust. Unlike bartered goods, coins were a reliable store of value.

4. Paper Money: From Gold to Promises

As economies grew, lugging gold became impractical. Banks stored gold and issued paper receipts (early banknotes) representing it. Over time, people traded these notes instead of gold, leading to fiat currencies—money backed by government trust, not physical assets. This shift allowed unlimited money printing, sparking inflation and instability.

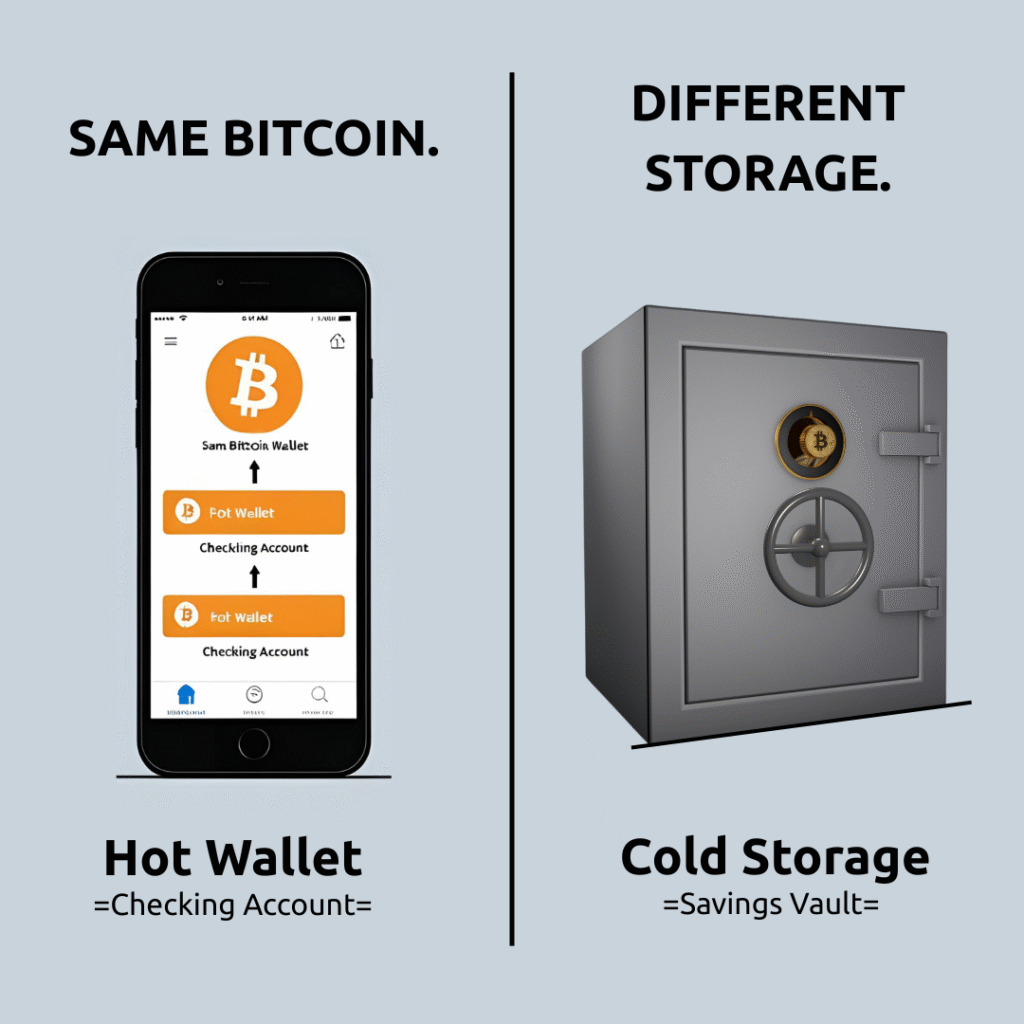

5. Bitcoin: Digital Money for a New Era

In 2009, Bitcoin revolutionized money. Created by Satoshi Nakamoto, it’s the first digital currency with a fixed supply of 21 million coins, making it immune to inflation. Unlike fiat, Bitcoin is decentralized, running on a global network of computers (blockchain) without banks or governments. It’s money controlled by math, not politics.

Why It Matters Today

Money’s evolution reflects our search for better systems. Fiat currencies, untied from gold since 1971, have lost value—$1 then equals $8 today (2025). Global debt hit $300 trillion in 2024, and inflation squeezes Canadian families. Bitcoin, adopted by companies like MicroStrategy and countries like El Salvador (2021 legal tender), offers a way out—a scarce, secure alternative to fiat’s flaws.

What’s the Future of Money?

Will fiat keep evolving, or is Bitcoin the next big leap? Share your thoughts in the comments or on X, and explore our post on Bitcoin’s rise to see how it’s reshaping finance.

Ready to Shape Your Financial Future?

Money has evolved, and Bitcoin is leading the next chapter. Don’t let fiat’s inflation erode your wealth, embrace a currency designed for the digital age.

Visit 1Bitcoin.ca for an easy guide to begin your Bitcoin journey, or download our free Bitcoin Starter Guide.

Join the future of money with Bitcoin! We make it simple for Canadians.

Disclaimer: Cryptocurrency investments carry market risks; past performance isn’t a predictor of future results. Consult a financial advisor before investing.