Is Real Estate Still Canada’s Go-To Investment?

For decades, real estate has been the backbone of wealth-building in Canada. From Vancouver condos to Toronto detached homes, property has promised stability and growth. But with soaring prices, rising interest rates, and inflation squeezing wallets, is real estate still king? Enter Bitcoin, a digital asset challenging traditional investments with unmatched advantages. Let’s compare Bitcoin and real estate to see which is the better bet for preserving your wealth in 2025.

Bitcoin vs. Real Estate: Head-to-Head

1. Liquidity: Cash Out Fast or Wait?

- Real Estate: Selling a home takes weeks or months, with hefty fees for agents, lawyers, and banks. In Canada’s cooling 2025 market, it’s even tougher.

- Bitcoin: Buy or sell instantly, 24/7, anywhere in the world, with minimal fees. No middlemen, no delays.

2. Costs: Maintenance vs. Freedom

- Real Estate: Properties come with endless expenses: property taxes, repairs, insurance, and mortgage interest. A Toronto home’s upkeep can cost thousands yearly.

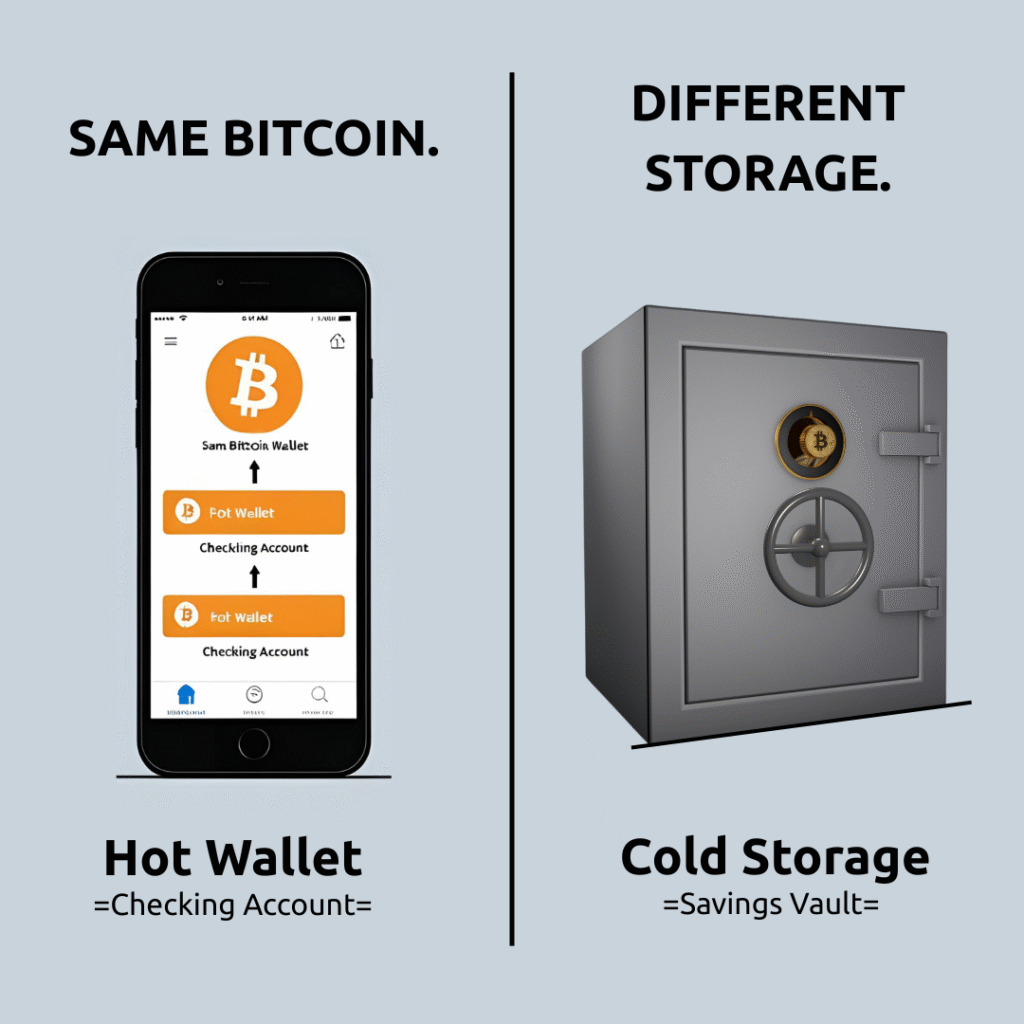

- Bitcoin: Zero maintenance. Once you own Bitcoin, there are no recurring costs, just secure storage on a wallet.

3. Portability: Fixed or Flexible?

- Real Estate: Tied to one location, subject to local regulations and market swings. You can’t move your condo to Calgary.

- Bitcoin: Borderless and portable. Store millions in Bitcoin on a USB drive or memorize your key, no borders, no limits.

4. Scarcity: Controlled or Uncontrollable?

- Real Estate: Governments can boost housing supply or tweak zoning, impacting prices. Canada’s 2025 housing policies aim to add 3.9 million homes by 2031.

- Bitcoin: Fixed at 21 million coins, forever. No government can inflate it, making it the hardest money ever.

5. Inflation Hedge: Safe or Shaky?

- Real Estate: Traditionally fights inflation, but rising rates and affordability issues (e.g., Toronto’s 40% price-to-income ratio) weaken its edge.

- Bitcoin: Deflationary by design. With fiat losing value—$1 in 1971 equals $8 in 2025—Bitcoin’s scarcity drives long-term growth.

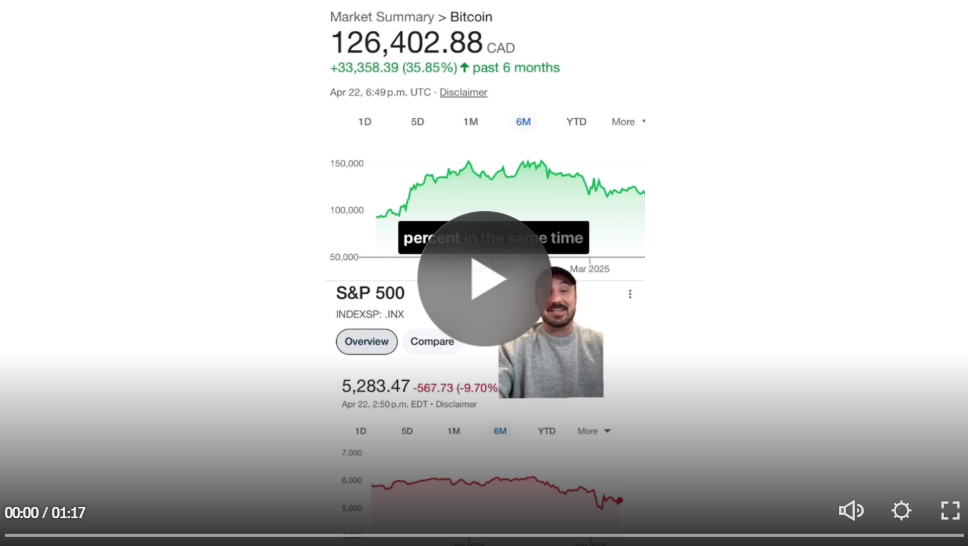

The Numbers Don’t Lie

Let’s look at performance (2015–2025, based on historical data):

- 10 Years: Canadian real estate averaged 6.11% annual growth; Bitcoin soared with 85.05% yearly returns. A $1 Bitcoin investment in 2015 is worth ~$470 today.

- 5 Years: Real estate grew steadily at 6.11%; Bitcoin delivered 854% total returns (110.9% annually).

- 3 Years: Real estate faced volatility; Bitcoin maintained strong upward trends.

- 1 Year (2024–2025): Real estate rose 3% year-over-year but dipped 2.6% month-over-month in December 2024; Bitcoin jumped 121.1% in 2024 alone.

When banks like BMO invest $150M in Bitcoin ETFs (February 2025), it’s clear: digital assets are gaining ground.

Why Bitcoin Shines for Wealth Preservation

Real estate offers shelter and rental income, but it’s no longer the unbeatable store of value. Canada’s housing market faces challenges—tighter regulations, high interest rates, and declining affordability. Bitcoin, with its fixed supply and global reach, thrives in this environment. Its 2024 surge to $65,000 (4.84% post-BMO investment) and adoption by firms like MicroStrategy show its momentum.

Bitcoin’s non-custodial nature—aligned with 1Bitcoin.ca’s mission—gives Canadians true financial freedom, unlike real estate’s ties to banks and governments. While real estate has its place, Bitcoin’s liquidity, scarcity, and inflation resistance make it a superior choice for preserving wealth.

Bitcoin, Real Estate, or Both?

Real estate isn’t dead, but Bitcoin is rewriting the rules. Should you swap your condo for crypto? Maybe not but diversifying with Bitcoin could protect your wealth. Share your thoughts in the comments or on X: Would you invest in Bitcoin over real estate? Check out our post on Bitcoin’s rise for more.

Ready to Preserve Your Wealth with Bitcoin?

Don’t let inflation and market volatility chip away at your savings. Bitcoin’s digital scarcity offers Canadians a powerful way to safeguard wealth.

Visit 1Bitcoin.ca for a simple guide to start investing, or grab our free Bitcoin Starter Guide.

Build your future with Bitcoin! We make it easy for Canadians.

Disclaimer: Bitcoin and real estate investments carry risks, including market fluctuations. Past performance isn’t a guarantee of future returns. Consult a financial advisor before investing.