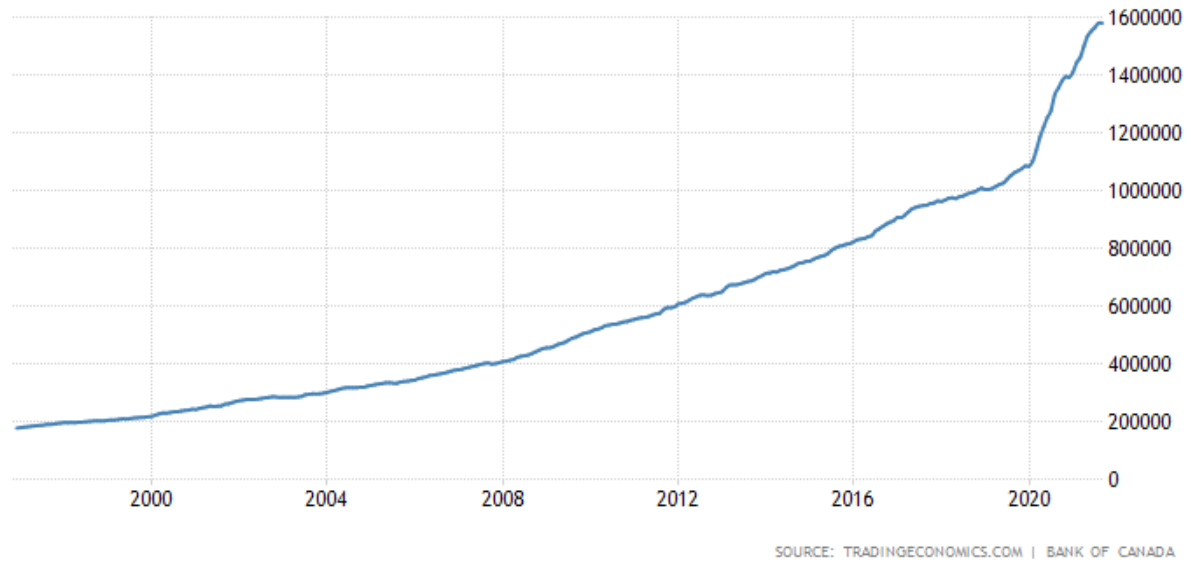

In the current fiat-based monetary system, savers are constantly punished. Today, all countries in the world use fiat currencies that are not backed by anything. With central banks able to print more money at will, the total supply increases and naturally dilutes the purchasing power of the general public.

When money is so easily created, savers are forced into risk assets just to preserve value. Mutual funds, stocks, real estate, collectibles, and other investments are no longer optional — they are required to try to outrun inflation. Even high-interest savings accounts fail to keep pace, causing buying power to slowly but surely evaporate.

Inflation is a very real issue that affects all of us. Living expenses rise while wages stagnate. This is where Bitcoin enters the conversation — not as speculation, but as savings technology. Bitcoin is the only monetary system in the world that is provably scarce. No one can increase or dilute its supply. For individuals beginning this journey, many choose to Buy Bitcoin in Canada specifically as a long-term savings vehicle rather than a short-term trade.

Bitcoin’s inflation rate is already lower than gold’s and will eventually become zero. This makes it uniquely suited for long-term wealth preservation and generational transfer. Over longer time horizons, Bitcoin has consistently preserved purchasing power despite short-term volatility. This is why the concept of “HODL” exists — disciplined saving rather than reactive trading.

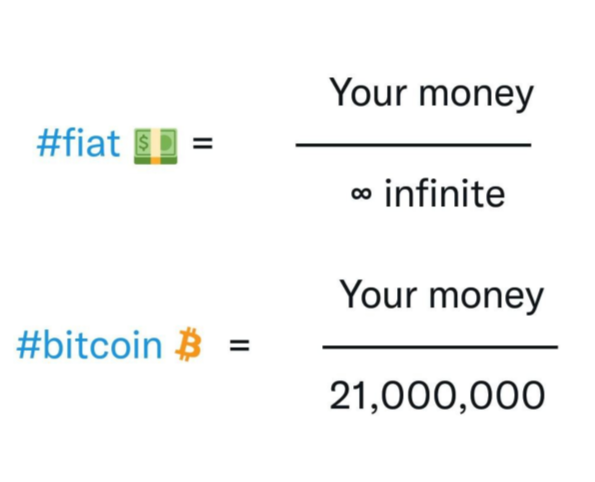

Assume you own one whole Bitcoin. You can be mathematically certain that you will always control one 21-millionth of the entire Bitcoin supply. No other asset offers this level of certainty. Stocks dilute. Real estate expands. Fiat currencies inflate endlessly. Bitcoin does none of these.

Because of these properties, Bitcoin is increasingly being adopted not only by individuals, but also by families and organizations looking to protect capital at scale. This has driven growing interest in Bitcoin for High Net Worth Canadians and long-term balance sheet strategies such as Corporate Treasury Bitcoin Canada.

Bitcoin is also fully auditable in real time — a feature no other asset can claim. Anyone can verify the supply, issuance schedule, and transaction history at any moment. This engineering breakthrough is why Bitcoin is increasingly viewed as superior savings infrastructure rather than just an investment.

And when liquidity is required, Bitcoin’s global 24/7 market ensures holders are never trapped. Capital can be accessed instantly through trusted Canadian services such as Sell Bitcoin Canada without the delays and friction common in legacy systems.

A true engineering marvel, Bitcoin offers savers something the fiat system never could: certainty. To learn more, reach out to the team at 1Bitcoin.ca — we are always happy to help Canadians understand how Bitcoin fits into long-term savings and wealth preservation.