One of the most common questions we get is, “What are your thoughts on ABC coin? What about XYZ—they’re working on smart contracts… Bitcoin is old tech.”

At 1Bitcoin.ca, we are focused exclusively on Bitcoin. After thousands of hours of research, we believe it is imperative to focus on Bitcoin only. The free market is a beautiful thing, but when people are deciding how to allocate capital, understanding why Bitcoin stands apart is critical—especially before choosing where and how to Buy Bitcoin in Canada.

When you compare Bitcoin to any other coin, remember this distinction:

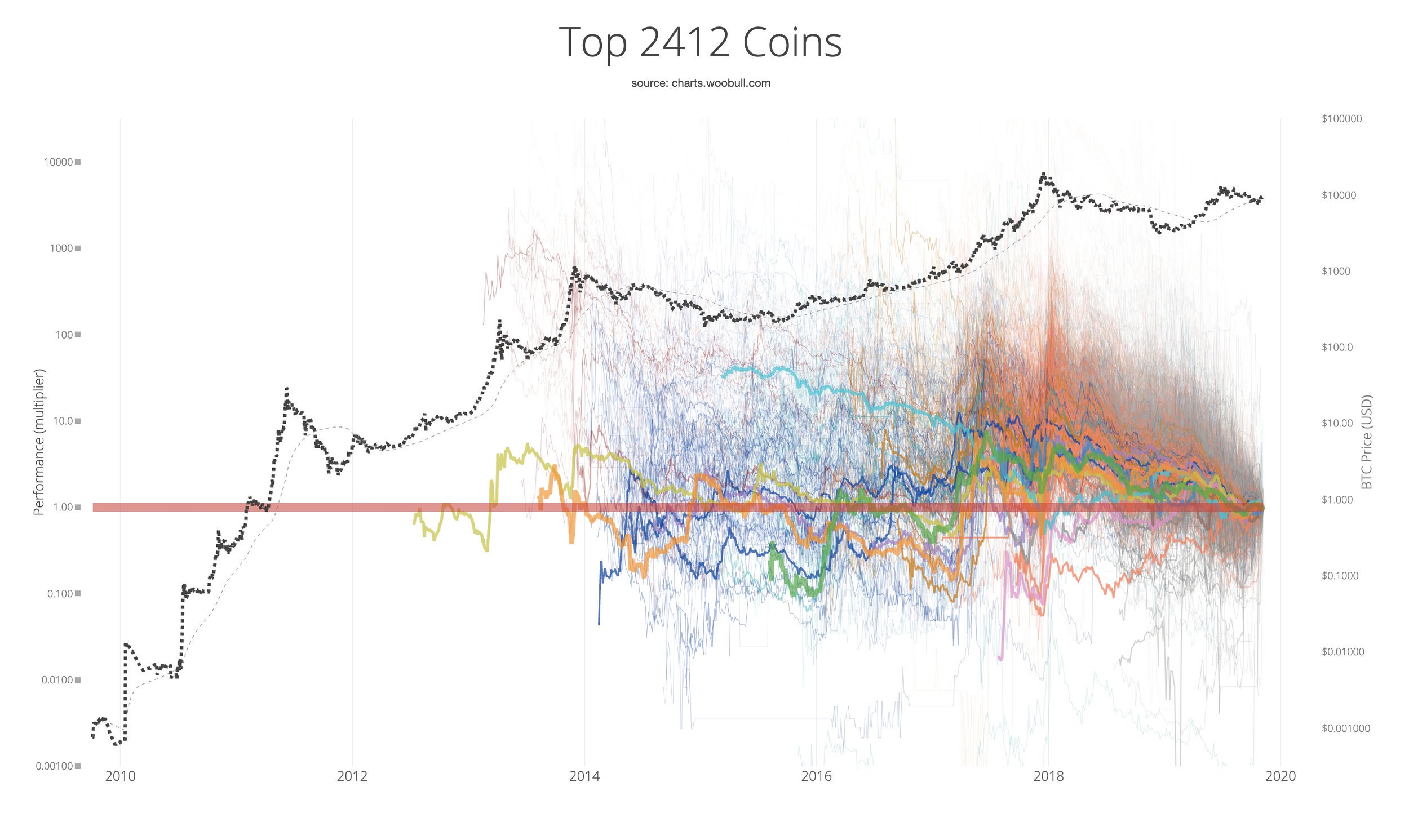

One is a decentralized monetary network protocol that no one controls—the most secure and liquid digital asset, increasingly adopted by nations and corporations worldwide. The other is typically a centralized entity with a marketing department, selling a narrative and searching for a use case. History shows that 99.9% of these so-called “altcoins” will not survive the decade.

Bitcoin cannot be recreated in this day and age. One of its greatest strengths is its origin—launched quietly, without a company, marketing budget, or founder enriching themselves. This unrepeatable creation environment underpins true digital scarcity. Everything else, including altcoins, exists above Bitcoin in the denominator.

A new foundation is being built on the Bitcoin protocol: a sound monetary network that allows everyone to operate on a fair and open platform. Network effects naturally converge on one dominant protocol—we don’t use multiple internets, and we won’t use multiple forms of money. This is why Bitcoin is increasingly being considered for Corporate Treasury Bitcoin Canada strategies by forward-thinking organizations.

Bitcoin has accreted value at over 100% annually for more than a decade. It is a revolutionary technology that helps bank the unbanked and protects individuals from monetary debasement. As adoption grows, many sophisticated investors are seeking tailored guidance through Bitcoin for High Net Worth Canadians to ensure their exposure aligns with long-term wealth preservation goals.

The broader “crypto industry” is largely an extension of the existing financial system—venture capital insiders, premines, and speculation. Crypto resembles the Pets.com era of the internet bubble, while Bitcoin stands alone as the blue-chip, long-term asset.

People new to Bitcoin often suffer from unit bias, believing cheaper coins offer greater upside. This misunderstanding leads many to gamble rather than invest. Diversification within crypto is often a misnomer—Bitcoin has already won the contest as the best store of value. For those who eventually choose to rebalance or exit responsibly, understanding how to Sell Bitcoin Canada is just as important as buying wisely.

Our goal is to educate the public and help people avoid the common mistakes made when first entering Bitcoin. We don’t comment on other digital assets—we’re here when you want to learn about Bitcoin specifically.