The 2008 Financial Crisis: A Broken System Exposed

In 2008, the world watched as the global economy crumbled. Banks collapsed, stock markets tanked, and trust in traditional finance hit rock bottom. Governments printed trillions to bail out the very institutions that caused the mess, leaving ordinary people to lose homes, savings, and hope. The system wasn’t just flawed—it was centralized, opaque, and fragile. In the years since, many Canadians have sought ways to opt out of this system entirely, starting with learning how to directly own Bitcoin, rather than relying on banks, through resources like Buy Bitcoin in Canada.

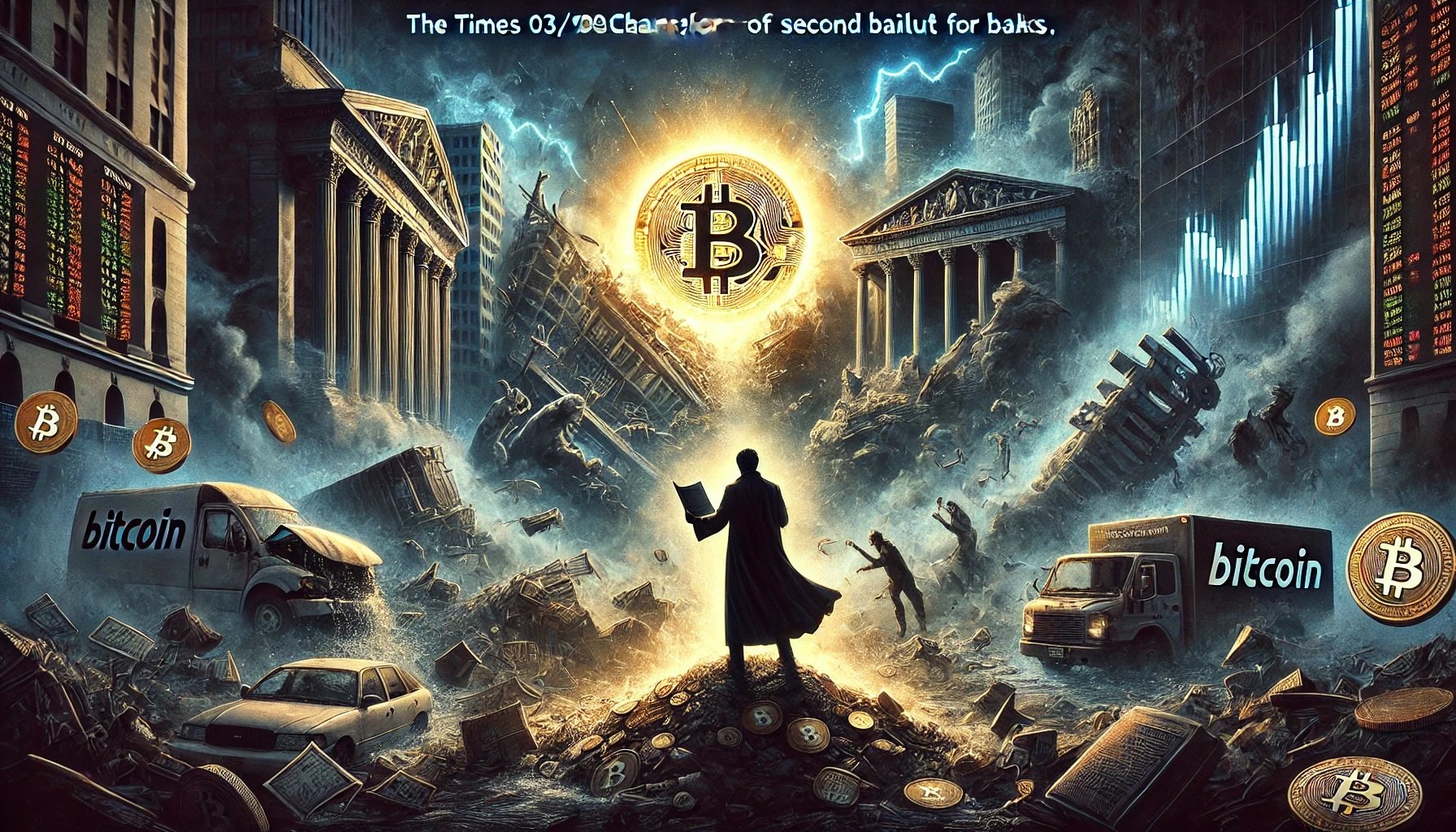

Enter Bitcoin: a bold idea born from chaos. On October 31, 2008, an anonymous figure (or group) named Satoshi Nakamoto released the Bitcoin whitepaper, Bitcoin: A Peer-to-Peer Electronic Cash System. It wasn’t just a technical proposal—it was a declaration of monetary independence.

What Makes Bitcoin Different?

Unlike traditional currencies, Bitcoin operates without banks or governments. Its design directly addresses the failures exposed in 2008:

- Secured by cryptography: Transactions are verifiable and tamper-resistant

- Decentralized network: Thousands of independent nodes enforce the rules

- Fixed supply: Only 21 million bitcoins will ever exist

These properties have made Bitcoin attractive not only to individuals, but also to entrepreneurs and companies seeking money that cannot be arbitrarily inflated—fueling adoption across Bitcoin for Businesses Canada.

On January 3, 2009, Satoshi mined Bitcoin’s first block—the Genesis Block. Embedded within it was a message referencing a second bank bailout, making Bitcoin’s purpose unmistakably clear: money without bailouts, censorship, or trust in centralized institutions.

The First Transaction and a $500 Million Pizza

Shortly after launch, Satoshi sent the first Bitcoin transaction to developer Hal Finney, proving peer-to-peer digital money worked. In 2010, Bitcoin made history when Laszlo Hanyecz paid 10,000 BTC for two pizzas—worth over $500 million today. This moment proved Bitcoin could function as real money, not just an experiment.

As Bitcoin matured, larger participants entered the ecosystem. High-value buyers increasingly required discreet execution, liquidity, and settlement expertise—needs commonly addressed through Bitcoin OTC Canada services.

A Rocky Road to Revolution

Bitcoin’s path has been volatile. Its price surged and crashed. Governments threatened bans. Banks dismissed it as a bubble. Yet Bitcoin persisted—because it isn’t just software, it’s a monetary network immune to political manipulation.

In countries facing hyperinflation or capital controls, Bitcoin became a lifeline. For investors in stable economies, it evolved into digital gold—a hedge against reckless money printing. This role has driven adoption among long-term allocators and family offices seeking resilience, including those served by Bitcoin for High Net Worth Canadians.

Satoshi’s Legacy and Bitcoin’s Future

In 2011, Satoshi Nakamoto disappeared, leaving Bitcoin fully decentralized. Since then, corporations like MicroStrategy and Tesla have added Bitcoin to their balance sheets, while El Salvador made it legal tender. With a market cap exceeding $1 trillion as of 2025, Bitcoin has permanently altered how the world thinks about money.

Despite criticism around energy usage, innovations such as renewable-powered mining and scaling solutions continue to strengthen the network. The real question is no longer whether Bitcoin works—but how deeply it will reshape global finance.

Ready to Join the Bitcoin Revolution?

Bitcoin was born from crisis, but its mission endures: honest money, owned and controlled by individuals—not institutions.